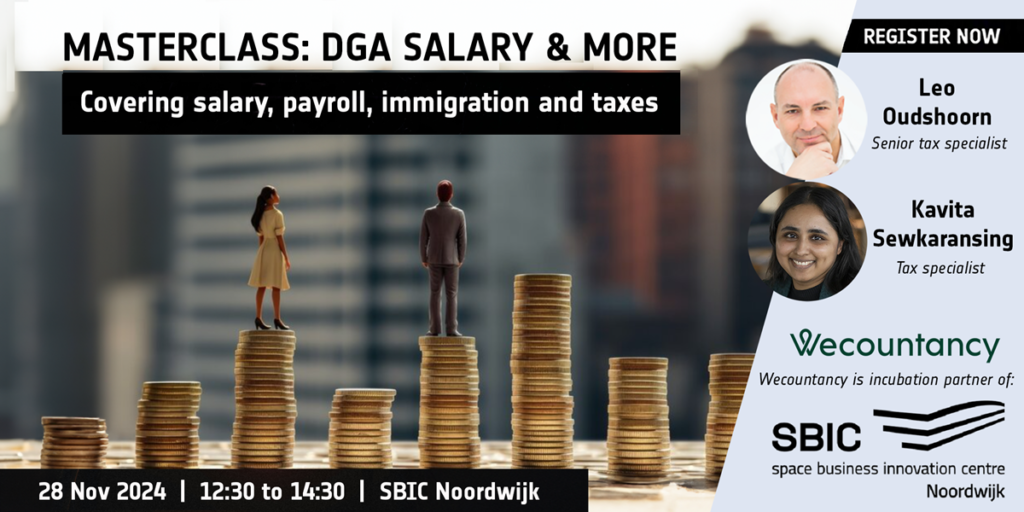

Do you have questions about salary/payroll and fulfilment of financial & tax obligations as an entrepreneur? Then, join this informative masterclass with tax specialists Leo Oudshoorn and Kavita Sewkaransing of Wecountancy on 28 Nov. It will cover startup salary, payroll, immigration matters and income tax. Secure your spot to get to grips with all your company’s and employees’ tax-related requirements. Register now

Taxing matters for entrepreneurs

Paying taxes – it might not be fun but it is just a fact of life. As a startup founder, you have to arrange setting up the company, ensuring a minimum standard living and making the activities profitable. Once you have set up your entity as a BV (equivalent to private limited company), Dutch regulations must be followed. As a director/major shareholder (“DGA”) of your company, a certain minimum required salary must be payrolled and withholdings must be paid to the tax office every month. When it comes to hiring employees, perhaps even from outside the Netherlands/EU, there are also a multitude of requirements you will need to know about.Get your questions answered

The masterclass will be split into two parts, with each section having a different focus. It is recommended that participants attend the entire programme to get all your questions answered. Here’s what you’ll learn about:

Part #1

- Identifying the DGA in your startup

- Definition of DGA salary

- Different DGA salary levels

- What if earnings are below the DGA salary threshold?

Part #2

- Payroll and administrative requirements

- Personal income tax return

- Immigration of non-Dutch nationals, IND and permits

- 30% ruling and tax incentives

In this masterclass, Leo and Kavita will highlight the DGA salary rules, what it takes to process a payroll and what further administrative requirements are imposed on the fulfilment of financial and tax obligations.

Expat services and expertise

The presenters Leo and Kavita are from SBIC incubation partner Wecountancy – where they lead Wecountancy Expat Services (WES). They will share not only their wealth of expert knowledge but also their personal experiences of working in the startup and entrepreneurial ecosystem. WES focuses on tax compliance, advice on (international) tax/social security matters and payroll. The team has specific professional experience in guiding (international) startups, their directors and expats. Services such as immigration law for (non)-EU nationals and labour law/HR services are also offered.

Secure your spot now and get to grips with all your company’s and employees’ tax-related requirements.

ABOUT THE PRESENTERS

Leo Oudshoorn joined WES in 1999, after working for a number of years at one of the largest tax consultancy firms in the Netherlands. His main goal is to help companies to set up business in the Netherlands and to offer advice on tax savings and deductibles, as well as on ways to increase net spending money for employees.

Kavita Sewkaransing began working at WES in 2017, first as a general tax consultant before moving on to guiding startups and advising on corporate and personal income tax issues and cross-border assignments.

GOOD TO KNOW:

The event is open to all. It is free for ESA BIC startups and SBIC community members (check the Slack channel for your link). If you are not in our community yet, sign up for membership here! Students can get 50% discount when registering for this event. Get in touch using your institution’s email address.